Banking, you’ve changed.

Technology is giving bank institutional sales teams the ability to personalise research for their customers – and they are loving the difference.

To compete effectively, banks need to offer personalised, intelligent services and information to their customers who are rightly demanding more. That means the research they need or didn’t even know they needed, powered by an intelligent eye on their needs.

The bank sales function deserves more support with technology to help them personalise research content for their clients. These are high ticket, valued customers. The generic is no longer enough.

Technology is adding to the relationship between bank sales teams and their customers through personalising services, targeting information, ideas, opportunities which really take into account the individual need, interests and past behaviours of the customer. In short, by providing personalised, relevant research, banks can demonstrate they understand their client.

And responding to questions quickly with accurate information, they can show they are responsive and care about their clients, providing a better customer experience.

It’s all about demonstrating they understand their client, and by responding to questions quickly with accurate information, they can show they are responsive and care about their clients, ultimately providing a better, personalised experience.

Legacy methods of discovering, collecting and distributing financial research are slow, cumbersome and impersonal. Add to that the sheer volume of research and you have a perfect soup of inefficiency and a lack of the type of personalised information clients need from their bank.

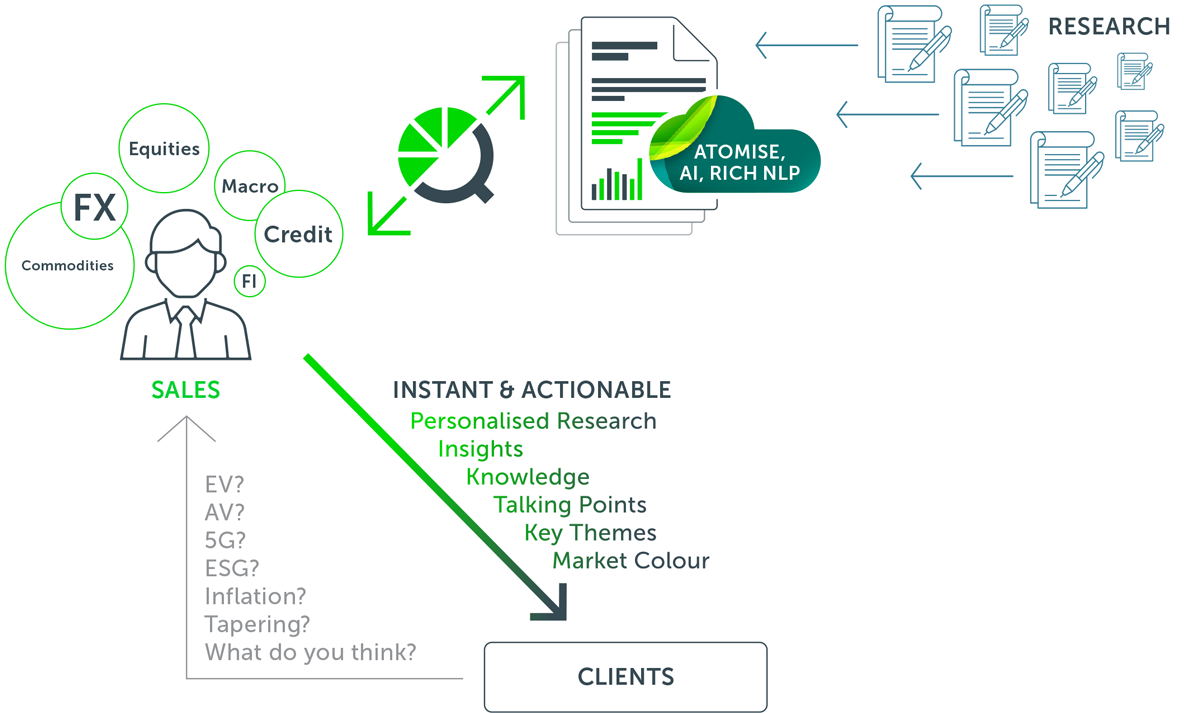

Research digitisation transforms the liability of information overload into the asset it was designed to be by harnessing next generation financial technology, artificial intelligence (AI) and rich natural language processing (NLP) to atomise financial research.

Technology can help banks produce hyper-personalised research for their clients by enabling them to review research at the paragraph-level without needing to open each document individually. This enables the banks to customise in-house research to respond to the needs of their clients in near real-time and offer genuinely personalised research for the first time that delivers value.

Limeglass is machine-tooled to help banks take this to the next level with hyper personalisation. It gives them the power to customise their wealth of in-house research and personalise it to the specific needs of their customers in near real-time.

Its technology takes account of synonyms and combinations of terms as well as a constantly evolving, expertly curated taxonomy, rather than limiting researchers by what they type into existing text search engines. This not only makes the customer feel understood, but it also makes them feel they have received a tailored service, resulting in deeper, personalised relationships between FIs and client.

Personalising research not only saves time, but it also helps banks to personalise their existing research while delivering accurate, actionable insights to their clients in an instant.

Research personalisation starts within the bank. The first step is to improve the internal distribution of research – between the research and sales teams – effectively getting personalised, customer appropriate content to the parts of the sales team who can really make it work for the instutution and onto usage – distributing it customers in an intelligent and focussed way which works for them too.

The output is powered-up research to deliver value. This gives the customer genuine utility, with research content which meets their specific needs, or is proactively delivered with thought and intelligence behind it from the bank’s team to add value.

The net effect is a more engaged, intelligence driven use of research which overall deepens the relationship across the enterprise. Win win.