Fixed income participants must digitise and optimise their research.

Fixed income trading is seeing a surge of interest and volumes traded due to the response to funding programmes set up by governments to mitigate problems created by the global health crisis and new inflation concerns. Investment decisions are critical, so how can financial research be optimised to offer the best results in a more electronic and colourless market? Rowland Park and Simon Gregory, co-founders of financial research technology company, Limeglass, look at how new technology can help.

In such volatile and competitive markets, the need for banks and investors to access appropriate information to generate a positive outcome is heightened.

Yet is it always possible to quickly identify this information in your body of research?

The quality of content that analysts produce is incredibly high and the value of their insights to traders, sales and clients can be significant. However, with budgets under significant pressure, report providers are having to work harder and smarter to demonstrate their value.

Thousands of pages of research are written each day on everything from the global economy to political statements, share prices and market moves. This overwhelming mass of publications can mean that key information and specific insights are not spotted.

Research Atomisation™

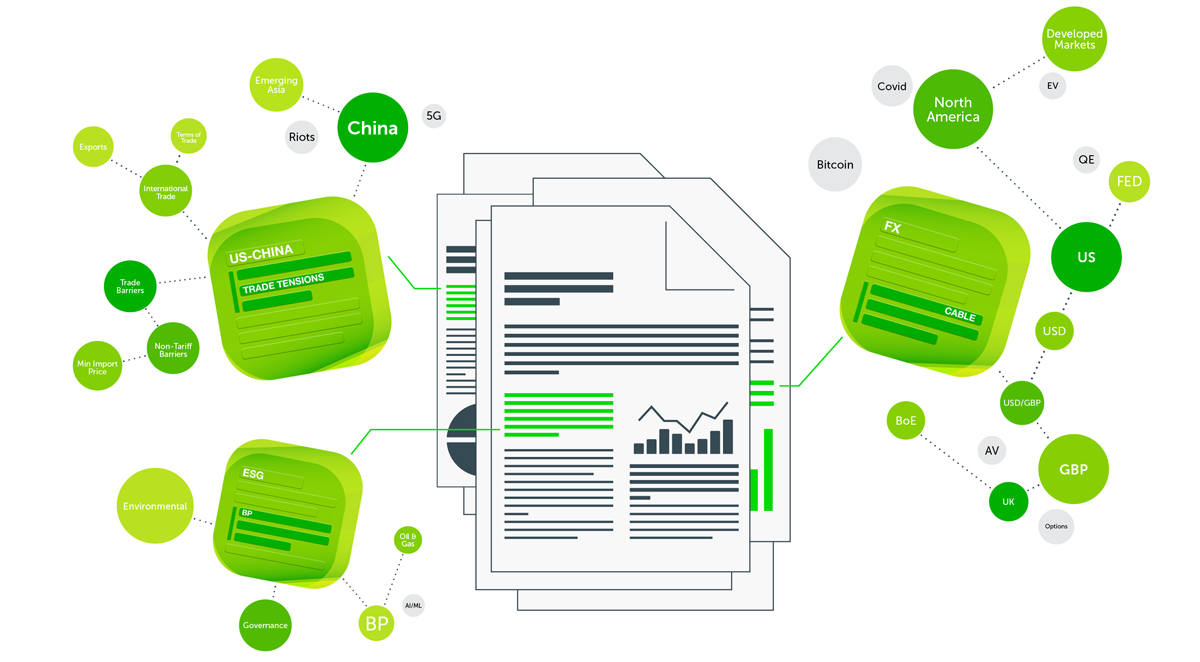

Limeglass’s key technologies allow reports to be automatically broken down into paragraphs (Document Atomisation™), and uses Rich Natural Language Processing (Rich-NLP) artificial intelligence to identify the actual context of each paragraph.

Rich-NLP understands the topics contained in each paragraph, enabling them to be tagged with synonymous and relevant ‘smart’ tags, and mapped within a financial knowledge-graph to provide a correlated directory for the fixed income market.

In this way, the atomisation and tagging processes turn unstructured reports into usefully structured material, giving a comprehensive overview of fixed income for the internal and external clients, leading to Research Digitisation1.

Knowing all the themes, as well as having granular metrics on every topic being written opens up all sorts of interesting opportunities for maximising current research.

How does this help fixed income markets?

Such a methodology not only offers a relevant, detailed and convenient manner of consuming reports, but also means that the results are – by their nature – hyper personalised to the users.

A firm may know what areas of fixed income their clients are interested in, but if there is no ability to only surface or distribute the precise topics the readers are interested in, the material will be of limited value and may not be read or fully appreciated. In disseminating specific paragraphs, the time and cost savings bring extensive benefits to both the firm and its clients.

With this technology, the recipient can assess the relevance of any fixed income reports much more quickly, and in so doing, the consequence is an enhanced relationship between the research producer and the client.

A hyper personalised flow of information will lead to Research Digitisation and better informed fixed income trading decisions. Moreover, the process provides a competitive edge for research firms and thereby leads to business success.

n: Research Digitisation – 1. The process of applying technology to automate the discovery, collection and distribution of relevant financial information by an institution to its clients or internal teams to increase efficiency