Limeglass Selected To Join Societe Generale’s Global Markets Incubator

23 September 2021

After a high-quality series of pitches, Societe Generale’s Global Markets Incubator (GMI) has invited seven start-ups to join in the adventure of developing tomorrow’s market leading solutions for the financial industry. The selected companies are decidedly data-oriented and focus on areas such as: pricing acceleration, data anonymization, data lineage, fluidity in data circulation and data insights.

The Limeglass Team is very excited to be working with the Societe Generale’s experts. Together we have the industry knowledge and technology to deliver business solutions for our industry.

Antoine Connault, Head of GMI

“These start-ups have innovation and entrepreneurship as building blocks of their DNA. Along with Societe Generale’s experts, we will tackle some of today’s hot challenges in the industry and look forward to repeating the successes we’ve had with previous GMI promotions!”

Rowland Park, CEO & Co-Founder

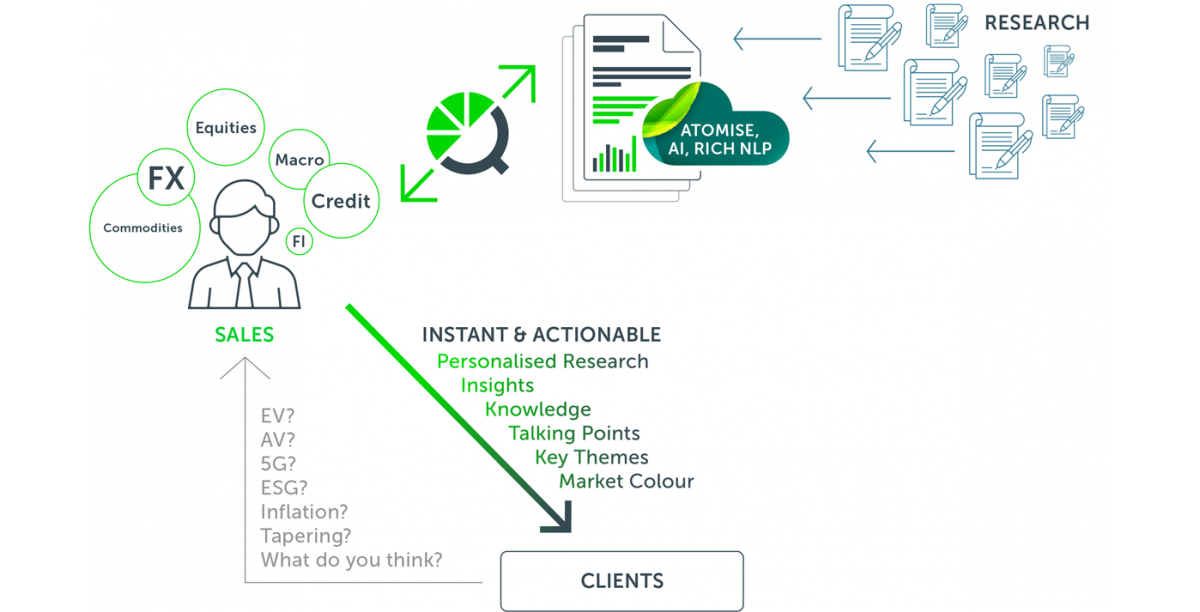

“We are delighted to be working with Societe Generale Corporate and Investment Banking – SGCIB Global Markets Incubator to help research and sales make the most of their strategic insights. Our Research Digitisation enhances research consumption and distribution by identifying paragraph-level insights using research optimised Rich-NLP.”

Simon Gregory, CTO & Co-Founder

“We are excited with this opportunity to work with Societe Generale’s CIB team to maximise the value of their in-house research for their sales team. Research Digitisation should be a key element of any financial institutions’ data strategy and Limeglass can harness the business knowledge, experience and technology to lead this evolution in the market.”

Research digitisation transforms the liability of information overload into the asset it was designed to be by harnessing next generation financial technology, artificial intelligence (AI) and rich natural language processing (NLP) to atomise financial research.

Technology can help banks produce hyper-personalised research for their clients by enabling them to review research at the paragraph-level without needing to open each document individually. This enables the banks to customise in-house research to respond to the needs of their clients in near real-time and offer genuinely personalised research for the first time that delivers value.