Research Discovery drives client engagement and takes client mind-share from competitors.

Act now to stop that from happening to you!

Oliver Hunt | Chief Product Officer | oliver.hunt@limeglass.com

Better Research Discovery increases the value of Investment Research to both the Buy Side and Sell Side. Everyone in the business acknowledges that the economics of producing written research and consuming it are poor:

- creating written content takes at least 50% of a sell side research budget

- but investors read less than 10% of what they receive

Yet, until now, there has been little urgency in addressing this industry-wide problem.

A few proactive Sell Side and Independent Research firms have realised that Research Discovery is the key and that Limeglass’s tools are by far the most powerful – 8 to 28 times more powerful!

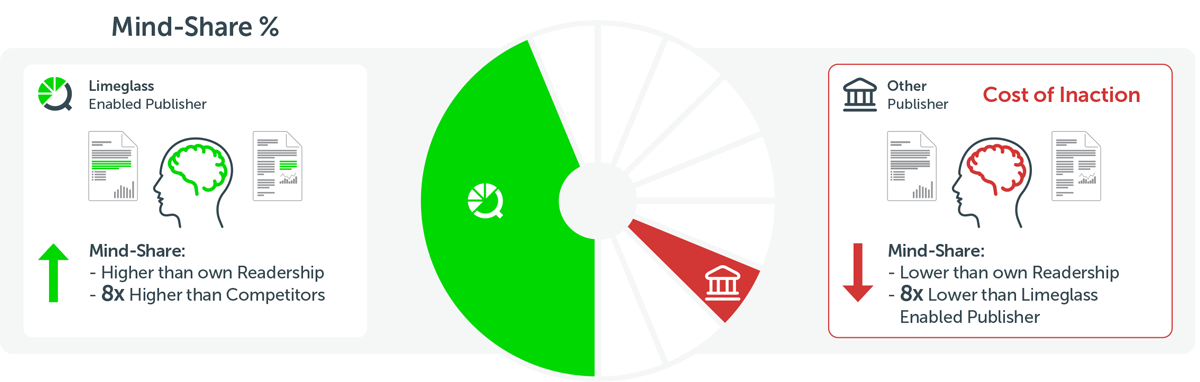

While that is proving beneficial for those proactive firms, others are starting to realise that inaction is no longer an option. The competition for an investor’s share of attention is a zero-sum game. An investor has a finite capacity to read research. Therefore, Sell Side firms using advanced Research Discovery tools can quickly steal mind-share from their competitors who are not.

Figure 1. Limeglass makes your research stand out from the crowd

Research Discovery is no longer a ‘nice-to-have’. It has become an urgent necessity for Banks and other Research Providers to avoid loss of mind-share and a significant blow to their reputations with investors.

Publishers using Limeglass discovery tools to enhance existing systems are able to get their investor clients to read 8x as much relevant research content as their competitors. And that is just using traditional, ‘passive’ discovery systems such as email distribution.

Publishers using a full suite of cutting-edge discovery tools, including ‘active’ tools like advanced search and ‘analytics’ tools using Limeglass’ industry-leading rich data, can achieve an even greater boost, at least 28x greater.

These numbers are based purely on the uniquely huge size of Limeglass’ proprietary knowledge graph. While most banks have research taxonomies generally smaller than 6,000 tags, Limeglass provides a 50,000 tag taxonomy for ‘passive’ systems and access to its full 170,000 knowledge graph for ‘active’ systems.

However, those numbers do not account for even more power in the Limeglass system. The ability to query combinations of tags in both ‘passive’ and ‘active’ cases means the 8x and 28x can actually be multitudes higher. Furthermore, the fact that Limeglass tags at paragraph-level (rather than document-level) also means that investor clients get a superior experience when looking for relevant content, often being taken directly to the few nuggets they need, rather than just being shown a document in which they have to go hunting for those nuggets.

Furthermore, for anyone attempting to harness the power of Generative AI with Research Discovery, the high-impact Limeglass approach provides the perfect high-quality, auditable input into Large Language Models.

So why should you start using Limeglass Research Discovery systems?

Because the advantage these tools are giving your competitors is not leaving your existing business flat – it is shrinking it.

Given the limited hours available to an investor to read research in a given period of time, they will run out of time to read research produced by firms without discovery tools. They will surely focus instead on the relevant research they know they are getting from discovery-enabled publishers.

The Cost of Inaction is tangible. As shown in Figure 2 below, Limeglass Discovery tools provide an enormous competitive advantage in capturing client mind-share. Even if you have an equal share of a client’s readership with your competitors, you can take an 8x greater share of that client’s mind by using Limeglass Research Discovery. Clearly, over time, those starting readership rates will start to shift towards the publisher with the more relevant research, further compounding the mind-share gains, and so on.

Discovery provides an immediate boost to Client Mind-Share

Limeglass can integrate rapidly and help you avoid Mind-Share loss

Figure 2. Improved ROI (Return on Investment) and decreased COI (Cost of Inaction) on your Research Economics.

For more information on how you can capture Investor mindshare with better Research Discovery tools, reach out to the experts at Limeglass.