How Limeglass can help Wealth Managers

The wealth management sector continues to face pressure as client expectations increase in a cost-conscious environment. This challenge is present despite favourable trends forecasting a continued surge in the number of wealthy individuals and families globally. The desire for each institution is to secure profitability while adding value to clients. Fortunately, wealth managers can turn to new technologies to gain an advantage. Limeglass is at the leading edge of this trend with its innovative approach to research discovery. Limeglass can ensure the relevant research piece reaches the right client at the right time.

Consider the typical wealth manager with a large number of clients to serve and a plethora of inhouse research reports published daily at their disposal. How best to deploy this arsenal so that the key differentiating insight pieces spark the interest of the client? Statistics reveal that clients value clear market insights highly. Indeed, “as the sheer volume of information available to anyone at the tap of a finger means clients are more discerning about who they listen to and trust.” is a media quote from a top global wealth manager. Still, sales and clients often struggle to find articles and maximise the power of the research.

The innovative Limeglass solution turns the liability of information overload into the asset that research was designed to be. Limeglass enhances the way research is both searched and presented using granular smart tagging and Rich NLP, transforming it into the differentiator it should be. It provides you with a unique tool to atomise, filter and navigate all your research, paragraph by paragraph. The technology applies to all financial asset classes, including equities, macro, FX, commodities and fixed income.

Limeglass ensures client relationship managers are much more efficient in managing idea flow and ensuring the right ideas reach the right client at the right time This feeds through in turn to fee structure and proving the fees represent excellent value to the end client.

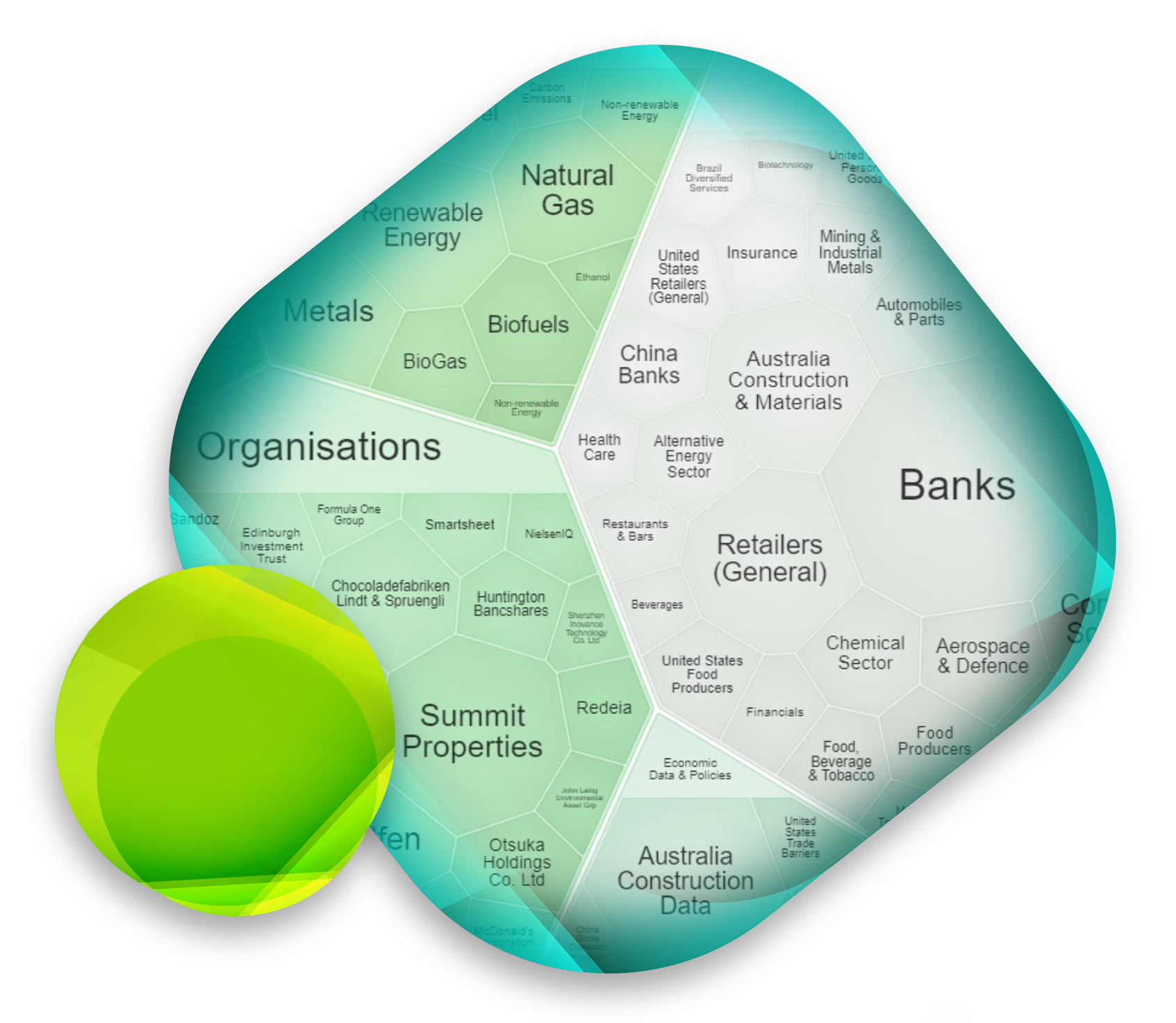

There are several exciting products now available to wealth managers in the wake of success with investment banks. The Heatmap product is one such example (see picture). Your latest top themes are identified by Limeglass daily and structured into an interactive graphic. You can click on any topic segment to access relevant articles with easy functionality to send onto clients. The reader can see what is published at a glance and what is trending while our constantly evolving taxonomy (180K tags) means you can keep up with new market themes. For example, current global themes most in demand from clients include geopolitical risk, inflation, rising debt levels and climate change.

From a business perspective, Limeglass can boost a firm’s return on investment (ROI) from written research. Written research is often a firm’s most underexploited asset. In summary, Limeglass can bring two clear benefits to the Wealth industry. Efficiency– the time saving gain and effectiveness– more time talking to clients with quality research insights that will lead to more informed investment decisions and increased revenue.

Limeglass can help you win new business and make your existing clients more profitable.

Let us show you how.